bpi savings online application|How do I open a new deposit account online? : Tuguegarao Open an account online in 4 easy steps. Step 1. Go to the app, tap "Open a new account", and tap "Create a bank account". Step 2. Fill out your personal details and account .

從 Broadway Lifestyle 百老匯在線購買電子產品。 數以百萬計的優質產品以折扣價提供。立即入來查看更多。

bpi savings online application,How to open an account online. Watch our step-by-step guide. Experience the new BPI app. DOWNLOAD NOW. Get these benefits when you open an account online. .

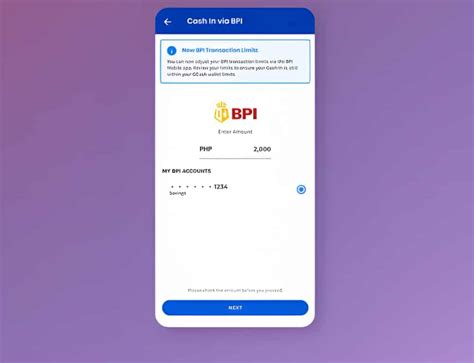

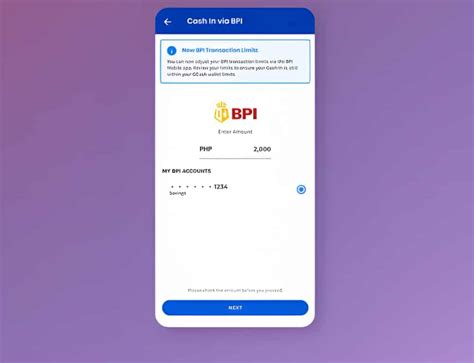

An all-digital BPI savings account that you can exclusively open using the GCash app.

How do I open a new deposit account online? If you have an existing BPI account, open an account online or visit a branch near .If you have an existing BPI account, open an account online or visit a branch near .bpi savings online applicationAn all-digital BPI savings account that you can exclusively open using the GCash app.Open an account online in 4 easy steps. Step 1. Go to the app, tap "Open a new account", and tap "Create a bank account". Step 2. Fill out your personal details and account .If you have an existing BPI account, open an account online or visit a branch near you. How to open a Regular Savings account online : 1. Select “Open a New Account”. 2. Tap “Open another deposit account”. .

1. Open the new BPI app and Log in your BPI Online account. 2. Go to More > New Deposit Account. 3. Tap Let's start and select the type of account you want to open. 4. .If you have an existing BPI account, open an account online or visit a branch near you. Here's how to open a Saver Plus account online: 1. Select “Open a New Account”. 2. .How can I open an account? If you have an existing deposit account with BPI, you may open another account through the BPI mobile app. You may visit this guide, How do I .

If you prefer to start your financial journey with BPI in the comfort of your home, you can open a BPI Savings Account online through the BPI mobile app. Take note that the type of BPI Savings . Open a savings account in 5 minutes with just 1 ID on the new BPI app. Download BPI: https://l.bpi.com.ph/DownloadBPIApp #DoMoreWithBPI 00:06 Requirements 00:41 Choosing a deposit product.

With the BPI app, you can easily transfer money between your BPI accounts, send money to other BPI accounts, or transfer funds to other local banks and .Requirements for a BPI Account. You may open a BPI deposit account in any BPI branch with just 1 valid ID. For your convenience, we have listed sample identification documents below as guide on what you can present: For Filipino Citizens. Phil ID and/or e-Phil ID.

Php 2,000,000. Amount needed to open your Maxi-Saver account. Required minimum monthly ADB. Php 2,000,000. ADB is the sum of the daily end-of-day account balances for a month divided by the number of days in that month. Required daily balance to earn interest. Php 2,000,000. Save and grow your funds.

Pay in-store and online with your BPI Debit Mastercard® and redeem drink upgrades. View details. Online. Shopping and essentials. Valid until Jul 31, 2024.Pay in-store and online with your BPI Debit Mastercard® and redeem drink upgrades. View details. Online. Shopping and essentials. Valid until Jul 31, 2024.Get up to Php 6,000 worth of free eGCs when you shop anywhere with your BPI Mastercard® Cre. View details. Online. Travel and leisure. Shopping and essentials. Restaurants. Installments. Valid until Jul 31, 2024.

Let BPI help you reach your dreams with our wide array of investment options and expert financial advice. . Your new one-stop app for everyday cashless transactions and rewards. Learn more. . A card-based savings account that lets you earn more as you save more. Get an additional 0.125

Open a Passbook savings account. Check the requirements you need before you visit your nearest BPI branch. Please bring the following account opening requirements below: 1. Proof of billing. 2. Client may submit only one (1) of the following IDs: For Filipino citizens, photo-bearing and unexpired identification documents: PhilID.

How to open a Saver Plus account. If you have an existing BPI account, open an account online or visit a branch near you. Here's how to open a Saver Plus account online: 1. Select “Open a New Account”. 2. Tap “Open another deposit account”. 3. .

Select #MySaveUp by BPI from the GSave Marketplace. 4. Tap Open a Savings Account. 5. Tap “Proceed using my GCash Profile” (or “Proceed using BPI Online Account” if applicable). 6. Input the requested personal details. 7. You will see a confirmation screen once successful.

Welcome to the BPI app! Managing your money has never been easier. Access your accounts, transfer funds, pay bills, and more, wherever you are, saving you frequent trips to the branch. FAST ONLINE ACCOUNT OPENING. 1 government ID and 5 minutes are all you need to open a BPI savings account.

How to apply. If you already have an existing BPI account, open a Foreign Currency Savings account online or visit a branch near you. Text: How to open a Foreign Currency account online: Select “Open a New Account”. Tap “Open another deposit account." Tap “Open account now." Choose your foreign currency. Read and agree to the terms and .

bpi savings online application How do I open a new deposit account online? 1. Log in to your BPI online account through the BPI app or via web browser. 2. Tap or click on the settings icon (⚙️) in the upper right corner of your home screen. 3. Scroll down to Transactions and select Manage Favorites > Add new Favorite. 4. Select Billers, then select your biller’s name from the list. 5.

Welcome to the BPI app! Managing your money has never been easier. Access your accounts, transfer funds, pay bills, and more, wherever you are, saving you frequent trips to the branch. FAST ONLINE .Get up to Php 6,000 worth of free eGCs when you shop anywhere with your BPI Mastercard® Cre. View details. Online. Travel and leisure. Shopping and essentials. Restaurants. Installments. EXPLORE PROMOTIONS.The estimated monthly amortization is Php 1,907 with ACR of 25.60%. Compute for your loan here. For inquiries and comments, send us a message or call our 24-hour BPI Contact Center at (+632) 889-10000. BPI is regulated by the Bangko Sentral ng Pilipinas (https://www.bsp.gov.ph).

BPI is Regulated by the Bangko Sentral ng Pilipinas https://www.bsp.gov.ph To make sure that you have the best browsing experience on mobile, kindly use the latest Google Chrome, Apple Safari, or Microsoft Edge browser.2. Enter your product details and birth date, then tap Continue. 3. Enter your preferred username and password, and the email address you will use to link to your account. Verify via SMS-OTP. 4. Log in to your BPI Online account then go to More > New Deposit Account. 5. Tap Let's start. and select the type of account you want to open. Jumpstart is the junior savings account designed for children and teens to help them develop the habit of saving at an early age. Here's how to get started! . Load your mobile phone from any BPI ATM or through BPI Mobile App or BPI Online. Open a Jumpstart savings account I don’t have a BPI Account.

Here is how to open a regular BPI savings account online if you have an account with this bank: Download and install a BPI Mobile app on your phone. Choose “Open a New Account” on the app's login screen. Click “Open another deposit account.”. Click “Open account now.”. Select “PHP” as currency.

bpi savings online application|How do I open a new deposit account online?

PH0 · Savings Accounts

PH1 · Saver Plus

PH2 · Regular Savings

PH3 · Open an Account Online

PH4 · How do I open a new deposit account online?

PH5 · How can I open an account?

PH6 · How To Open BPI Savings Account 2023

PH7 · How To Open An Account Online

PH8 · BPI